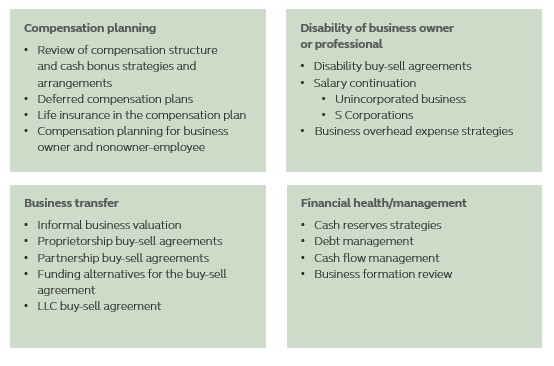

Business planning topics

Our business planning services look at the entire financial situation of your business. Below is a list of topics that we may cover during the process.

The subject matter in this communication is provided with the understanding that Principal® is not rendering legal, accounting, or tax advice. You should consult with appropriate counsel, and other advisors on all matters pertaining to legal, tax, or accounting obligations and requirements.